- 70% allow struggling clients to pay fees monthly or over an extended period

- Nine out of ten experiencing worsening cashflow as a result

Accountants and financial advisers increasingly are seeing clients struggle to pay their fees with a knock on effect on their cashflow, new research* from Premium Credit, a leading provider of finance for businesses, shows.

Nearly nine out of 10 (87%) say more clients are struggling to pay their fees and nearly three out of four (74%) expect a rise in the number of clients finding it hard to pay fees over the next 12 months.

More than nine out of 10 (91%) say that clients not paying fees on time has been a factor in cashflow worsening with 27% saying it has been the main factor. The study found 70% are now allowing some clients to pay fees monthly or over an extended period and 68% say they would consider allowing some clients to pay fees monthly or over an extended period.

Up to 85% of accountants and financial advisers say they would consider using a scheme enabling clients to spread the cost of fees into convenient monthly payments or recommending one to clients.

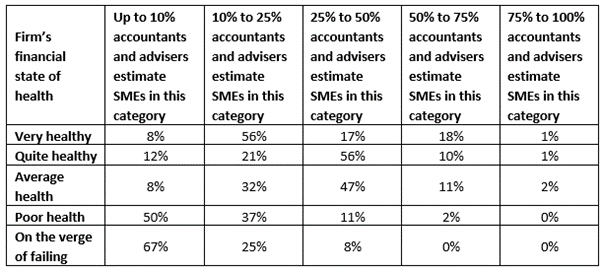

The study found that accountants and financial advisers are seeing increasing financial distress among clients as the table below shows. Two-thirds (67%) estimate that up to 10% of clients’ businesses are on the verge of failing while half (50%) estimate up to 10% of clients' businesses are in poor health.

Accountants and financial advisers are split over whether HMRC is getting tougher on tax arrears and debts with 41% saying yes and 46% saying it is becoming more supportive. They are also split on the potential impact of Employers’ National Insurance and minimum wage increases on the businesses they work with and the economy as a whole.

More than half (52%) say the increased costs will lead to employers cutting staff and recruitment and 41% say they will hit profits. Around 35% worry the increased Employers’ National Insurance and minimum wage will cut jobs in the economy as a whole while 29% say it will contribute to reduced GDP.

Jennie Hill, Chief Commercial Officer, Premium Credit (Specialist Finance) said: “Accountants and financial advisers are heavily reliant on clients paying fees and paying them on time so it is inevitable that when clients struggle to pay fees accountants and financial advisers suffer.

“It is however clear that accountants and financial advisers are being flexible to support clients who clearly are also suffering. Using schemes which enable clients to spread the cost of fees into convenient monthly payments would help both sides and ensure bills are paid on time removing any risk to cashflow.”

Notes:

* Independent research conducted by Pureprofile among 100 accountants and financial advisers who advise on corporation tax, VAT and income tax during April 2025

** Independent research conducted by Pureprofile among 105 accountants and financial advisers who advise on corporation tax, VAT and income tax during March 2024.

Premium Credit’s Tax and VAT funding proposition allows companies and business owners to spread the cost of their VAT, corporation tax and self-assessment tax payments for up to a year. The number of customers using the service has more than doubled in the past two years by 108% while the total value of lending provided last year was 52% higher than in 2022. The first quarter of this year has seen a 37% rise on the same period last year in terms of total lending and a 22% rise in customers.