- Cost for a child will be £107,000 extra over a school career if they board and nearly £74,000 in addition for day schools

- Research shows private schools aim to limit increases to 10% on average but worry around 14% of pupils could leave

Private school parents face paying as much as £107,000 extra over their child’s school career as a result of VAT on school fees taking effect from the start of next year, analysis* by leading finance company Premium Credit shows.

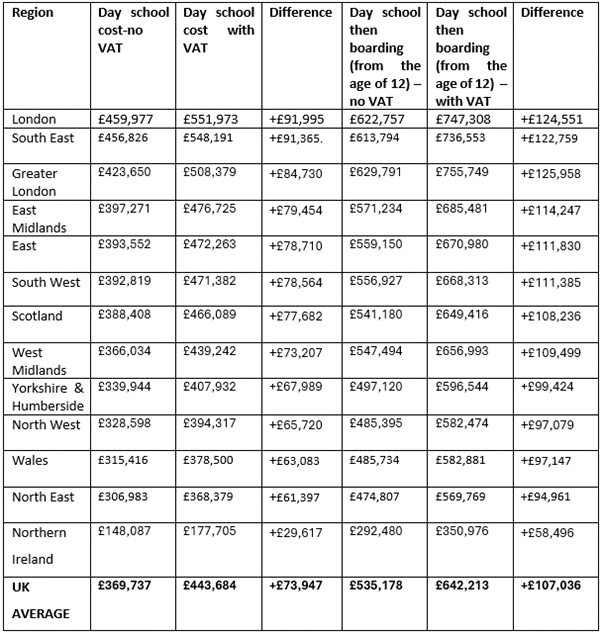

It estimates fees paid for a child starting private day school at age five and moving to a boarding school at age 12 until they are 18 will be £107,000 higher if the full 20% VAT is passed on to parents. The analysis takes into account annual fee rises of 4%.

Fees for a five-year-old starting at a private day school and leaving at 18 will be £73,947 higher if the full 20% VAT is passed on to parents, the data from Premium Credit, which through its School Fee Plan (SFP) provides funding to parents enabling them to spread the cost of their children’s school fees, shows.

The Government has announced that 20% VAT on private school fees will take effect from the school term beginning in January 2025 and that parents will be unable to avoid it by paying for fees in advance with all fees paid between July 29th and the Budget on October 30th covered by VAT. Private schools will also have to pay full business rates from April 2025 having previously been eligible for charitable rates relief of 80%.

Premium Credit’s analysis shows parents in London will feel the pain most – if VAT is passed on in full by schools, they will pay nearly £92,000 more at day schools from age five to 18 and £124,500 for day and boarding schools. The impact of VAT on fees will be lowest in Northern Ireland at £29,600 for day schools and £58,500 for day and boarding schools.

Premium Credit’s research** with headteachers, bursars and finance managers at fee-paying schools found that on average they expect to pass on half of the VAT pushing fees up by 10% and believe that on average one in seven (14%) of pupils would be at risk of leaving as a result. However, following conversations over the last few months with many of Premium Credit’s school partners it is now looking more likely that the average pass through of VAT impact to parents is likely to be between 15 & 16%. Analysis by the Institute for Fiscal Studies*** estimated that private schools would increase fees by 15% as a result of VAT being imposed on school fees leading to between 3% and 7% of pupils leaving. The Adam Smith Institute Research paper and other media outlets estimates in respect of pupils leaving to be educated in the State Sector are much higher – with the highest estimate being 40%!

The table shows the additional cost around the country for parents of pupils starting at age 5 and staying at school till age 18 if the full 20% VAT is passed on. All figures assume a 4% increase each year in fees.

Premium Credit’s research found nearly two out of three (66%) of private schools surveyed will cut back on recruitment in order to limit fee increases if VAT is applied to fees while 50% will reduce investment in infrastructure and 44% will limit pay increases for staff. Around 21% will reduce spending on equipment.

Stewart Ward, Director Education Sector & Head of School Fee Plan, Premium Credit said: “The impact on parents over a child’s school career of adding the full 20% VAT to fees is substantial and may mean some will decide they cannot afford the expense or indeed will need to consider other ways in which to manage the costs of the education for their family.

“However it is already the case that funding a child through private school is a major commitment with the average total cost at around £370,000 for day schools and £535,000 for day and boarding schools before any VAT is applied to school fees.

“All parents considering paying for private schools need to plan and budget carefully and we are increasingly seeing more parents, including those who are independently wealthy, using schemes such as our School Fee Plan to spread the cost of fees over a 12 month period.”

For over 25 years, SFP has offered parents the ability to finance school fees and spread the cost into monthly instalments rather than paying a lump sum each term. SFP is the convenient way for parents to pay for independent school fees and extras such as music tuition and trips. It splits the cost into regular monthly direct debits, like any other household bill.

The process of applying for SFP for both parents and schools is seamless. Parents apply to open their account online before the beginning of any term. If the application is approved, SFP will notify the parents and the school. SFP sends the full payment to the school at the start of each term.

For further information on SFP, please https://www.myschoolfeeplan.com/application/schoolfeeplan

Notes to editors:

* Based on Premium Credit analysis of data from schoolfeeschecker.com. This included the latest fees for day and boarding schools, and an annual increase of 4%. According to schoolfeeschecker.com, schools fees have been increasing by around 4% since 2016

** Premium Credit commissioned market research company Pureprofile to conduct research with 100 head teachers, bursars and finance managers at fee paying schools in the UK. The research was conducted online during March 2024

*** Tax, private school fees and state school spending (ifs.org.uk)