- Premium Credit’s Insurance Index shows 40% of customers using credit to buy insurance have borrowed more to fund cover in the past year

- That is an increase on the 34% who said they had borrowed more in the last Premium Credit Insurance Index in May 2022

The cost of living squeeze and energy bill increases are driving a surge in people borrowing more to fund insurance policies, new research (1) from the UK’s leading premium finance company, Premium Credit, shows.

Its study (1) found that two out of five (40%) of customers who use some form of credit to pay for one or more insurance policy - some 12.6 million people - borrowed more than they had in the previous 12 months for this purpose. Only 2% said they borrowed less. That is an increase on the 34% who said they had borrowed more in the previous 12 months when Premium Credit’s Insurance Index last reported (2) in May this year.

The main reasons for increasing borrowing identified by the research among those who use credit to buy insurance is the ongoing cost of living squeeze and rising energy bills. Around 35% said they had increased borrowing because their spending in general has increased while nearly one in four (23%) blamed rising energy bills for needing to borrow more.

When Premium Credit’s Insurance Index last reported in May (2) around 27% blamed increases in the cost of cover for their need to borrow more but just 11% said the same this time.

Around one in eight (13%) who have borrowed more to pay for credit in the past 12 months say they have taken out an extra £500 or more in credit. More than 10% say they have borrowed £1,000 or more to fund one or more insurance policies in the past year.

Around 6% who used credit to pay for one or more insurance policy said they had defaulted on repayments during the past year while 7% fear they will miss repayments in the year ahead. The comparable figures in the last Premium Credit Insurance Index were 5% for those who had defaulted and for those who fear they will miss repayments in the year ahead.

Some customers have had to cancel policies they can no longer afford – around 5% have cancelled buildings insurance and 2% have cancelled contents cover. That compares to 3% for buildings insurance and 3% for contents cover in the last index and 5% and 7% respectively in research conducted by Premium Credit in March (3) 2021.

Premium Credit’s Insurance Index, which monitors insurance buying and how it is financed twice yearly, found credit cards remain the most popular form of borrowing with 34% using them compared with 29% relying on finance from their insurer and/or premium finance. The comparable figures from the last Insurance Index were 35% and 27%.

The research shows 15% of people have become more accepting of using credit to pay for insurance, – but there are issues in being accepted for credit. Around 8% had been rejected for credit cards in the past year while 6% were offered a higher rate than the one they applied for.

Premium Credit is advising customers to consider premium finance which, for a small charge, enables them to pay monthly for cover instead of in a lump sum. Spreading payments in such a way can help ease cash flow challenges and make paying for vital insurance simpler.

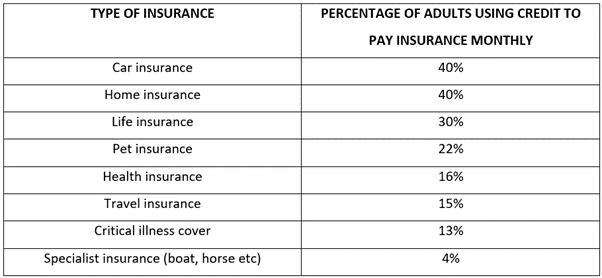

Its study shows widespread use of credit by consumers, as the table below demonstrates.

Adam Morghem, Premium Credit’s Strategy, Marketing & Communications Director said: “Rising interest rates, the cost of living squeeze and eye-watering energy bills are having a major impact on how people pay for insurance with rising numbers borrowing more to ensure they keep important cover, but not always considering the most efficient payment options available to them.

Our existing support for vulnerable customers is tried and tested, and we are reviewing what additional support is appropriate during this time of uncertainty.

Premium finance is specifically designed for insurance buyers to help make important insurance policies affordable and improve cashflow. Premium finance has become a very cost-competitive means for consumers to buy insurance and better manage their finances. At a time when household finances are under pressure it can be a good alternative to other forms of credit.”

Premium Credit’s research highlighted the cost of not having the right insurance – around 7% of people have not been able to make claims in the past five years either because they had no cover or had inadequate cover. Nearly six out of ten (58%) of them lost out on claims worth £1,000 or more.

Notes:

(1) Independent consumer research conducted by Consumer Intelligence among a nationally representative sample of 1,043 adults aged 18-plus between September 16th and 20th 2022

(2) Independent consumer research conducted by Consumer Intelligence among a nationally representative sample of 1,026 aged 18-plus between March 11th and 13th 2022

(3) Independent research conducted by Consumer Intelligence online among a nationally representative sample of 1,014 adults aged 18-plus between March 26th and 29th 2021

For further information please call Phil Anderson at Perception A on 07767 491 519

Published in Insurance Times