Research reveals extent of Brexit related stockpiling by UK businesses and households

• One in five employees say their employers are Brexit stockpiling

• 17% of people say they have stockpiled at home over concerns about the impact of a bad Brexit

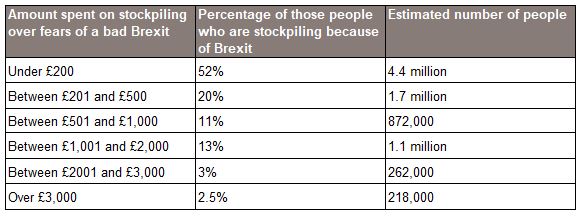

• Over 2.4 million people claim to have spent £500 or more on stockpiling

• 64% of people working for organisations that have stockpiled as a result of Brexit believe they have missed out on pay rises because of this

New research(1) reveals that 22% of people in work claim that their employers have started to stockpile goods over concerns about a bad Brexit, and a further 4% expect them to start doing this in the next few weeks.

In terms of households doing this, the findings, which are from Premium Credit, the UK’s leading premium finance company, reveals 17% of people have started to stockpile as a result of fears over a bad Brexit. Of those stockpiling, 80% said they have done this with food, 63% with medicine and 43% with drinks.

The impacts of stockpiling can be far-reaching and include companies and people having less cash and relying more on credit to make purchases from clothes, stock to insurance.

Premium Credit’s research reveals that 16% of people who work for employers that have been stockpiling claim it has had a ‘very negative’ impact on their cashflow, with a further 58% saying it has had a ‘slightly negative’ impact. Two out of three (66%) say it has adversely affected their employer’s expansion plans; 60% say this about their plans for recruitment; 51% about promotions, and 64% claim to have lost out on pay rises because of it.

Of those people stockpiling at home over fears of a bad Brexit, 30% some 2.44 million people – have spent more than £500 doing this. One in five (19%) have spent over £1,000.

Adam Morghem, Strategy and Marketing Director at Premium Credit said: “There are a lot of concerns regarding a bad Brexit, and our research reveals the extent to which both businesses and individuals are stockpiling as a result of this. The implications are much wider than many may suspect. From creating cashflow problems, to under insurance of stockpiled goods to curbing a business’ plans for expansion . Our findings also suggest that many people may also be missing out on promotions and pay rises as a result of Brexit related stockpiling."

“With cashflow being adversely affected, it puts pressure on businesses and individuals to rely more on credit to buy the goods and services they need.”

Premium Credit is the market leader in the UK and Ireland and the only premium finance provider accredited by BIBA.

Notes:

(1)The research company Consumer Intelligence conducted research with 1,158 consumers in the UK currently in employment. Interviews were conducted online between 11th and 13th March 2019.

With cashflow being adversely affected, it puts pressure on businesses and individuals to rely more on credit to buy the goods and services they need.