- 89% of headteachers, bursars and finance managers at fee-paying schools are increasingly looking at schemes to help parents spread the cost of their children’s fees

New research* with headteachers, bursars and finance managers at fee-paying private schools in the UK reveals that over the past three years, 74% have had to delay or cancel investing in new facilities and hiring staff because of delays in parents and carers paying their children’s fees. The study was commissioned by leading finance company Premium Credit, which through its School Fee Plan (SFP) provides funding to parents enabling them to spread the cost of their children’s school fees.

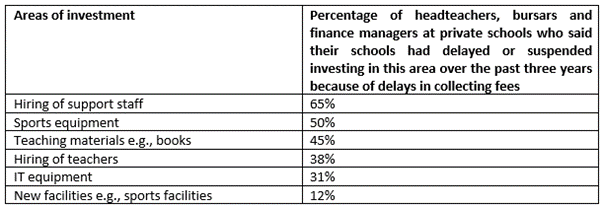

In terms of which areas private schools cancelled or suspended investing in because of late fee payments, 65% cited the hiring of support staff, and this was followed by 50% who said sports equipment, and 45% who cited teaching materials, such as books. Nearly four out of ten (38%) said they had delayed hiring teachers because of issues around school fees not being paid.

However, to tackle issues around payment of school fees, 89% of private school headteachers, bursars and finance managers revealed that they are increasingly looking at schemes run by professional firms to recommend to parents to help them spread the cost of their children’s school fees, such as Premium Credit’s School Fee Plan (SFP). The total lent through Premium Credit’s School Fee Plan (SFP) was around a quarter more last year than in 2021. Total lending increased by 10% last year compared to 2022 and the amount of funding provided through SFP in the first three months of this year is 9% more than the same period last year. The average amount of funding through SFP is now around £20,300.

Eight of ten (80%) private schools surveyed said they are looking to increase the amount of money they invest to enhance their facilities and attract the best teachers. Over the next two years, 67% of those interviewed said they expect their school’s level of expenditure on facilities and staff to increase by over 10%, and a further 21% anticipate a rise of between 5% and 10%. Only 6% expect expenditure to stay the same or fall.

Stewart Ward, Director Education Sector & Head of School Fee Plan, Premium Credit said: “Successful private schools need to work hard to ensure they have the best possible facilities and teachers to support pupils in meeting their full potential, and to keep attracting new students. This requires a significant annual investment and any delay in fees being paid can have a very detrimental impact on this.

“Schools are increasingly looking for ways to help parents and carers spread the cost of fees, and the convenience this offers them. This helps explain why year-on-year, we are seeing strong growth in terms of the money lent through our School Fee Plan, the number of schools offering it, and how many parents and carers are using it.”

For over 25 years, SFP has helped parents finance their children’s independent school fees by enabling them to spread the cost rather than paying a lump sum each term. SFP is the convenient and manageable way for parents to pay for independent school fees and extras such as music tuition and trips. It splits the cost into regular monthly direct debits, like any other household bill.

The process of applying for SFP for both parents and schools is seamless. Parents apply to open their account online before the beginning of any term. If the application is approved, SFP will notify the parents and the school. SFP sends the full payment to the school at the start of each term.

For further information on SFP, please visit https://www.myschoolfeeplan.com/application/schoolfeeplan

Notes to editors:

*Premium Credit commissioned market research company Pureprofile to conduct research with 100 head teachers, bursars and finance managers at fee paying schools in the UK. The research was conducted online during March 2024 .