- Many private schools would look to cover some of the increase from VAT being applied to school fees, which the Labour Party says it would do if elected to government

The Labour Party has pledged that if elected at the General Election, it would apply VAT to school fees, which could see parents paying up to 20% more. New research* with headteachers, bursars and finance managers at fee-paying private schools in the UK reveals 91% believe that 10% or more of their pupils would be at risk of leaving their school if VAT is applied to fees because their parents would not be able to afford to pay them. Some 35% believe between 15% and 30% could be at risk of leaving.

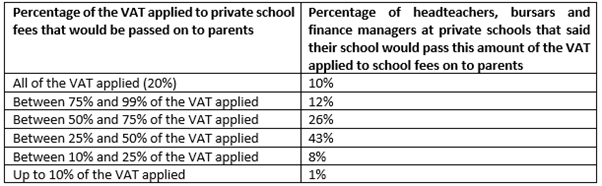

The study, which was commissioned by leading finance company Premium Credit, which through its School Fee Plan (SFP) provides funding to parents enabling them to spread the cost of their children’s school fees, reveals that many private schools would look to cover some of the increase in fees resulting from VAT being applied to them. Only one in ten (10%) of the headteachers, bursars and finance managers interviewed said their schools would pass on the full 20% increase. Some 52% of those interviewed said they would pass on 50% or less of the VAT increase.

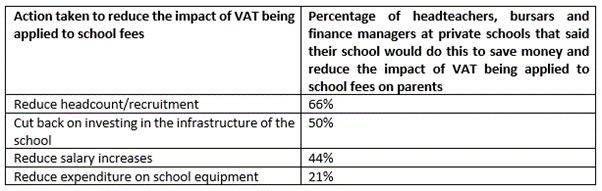

However, Premium Credit’s study reveals that in not passing on the full VAT increase to parents in higher fees and taking some of the financial hit from this themselves, many schools would look to make cutbacks as a result. Two thirds of private school headteachers, bursars and finance managers interviewed said they would look to reduce headcount at their school and use the money saved to reduce the impact of VAT on school fees, and one in two (50%) said they would invest less in the infrastructure of the school.

Stewart Ward, Director Education Sector & Head of School Fee Plan, Premium Credit said: “Schools fees are already substantial, around £16,374 a year for day school children, and around £39,000 for those that board**. Increasing these by up to 20% as a result of applying VAT would place a financial burden on many parents. However, our research shows that many private schools already have plans in place to reduce the full impact of this if it is introduced.

“We would also expect to see more parents using schemes such as our School Fee Plan to spread the cost of fees over a 12 month period.”

For over 25 years, SFP has helped parents finance their children’s independent school fees by enabling them to spread the cost rather than paying a lump sum each term. SFP is the convenient way for parents to pay for independent school fees and extras such as music tuition and trips. It splits the cost into regular monthly direct debits, like any other household bill.

The process of applying for SFP for both parents and schools is seamless. Parents apply to open their account online before the beginning of any term. If the application is approved, SFP will notify the parents and the school. SFP sends the full payment to the school at the start of each term.

For further information on SFP, please visit https://www.myschoolfeeplan.com/

Notes to editors:

*Premium Credit commissioned market research company Pureprofile to conduct research with 100 head teachers, bursars and finance managers at fee paying schools in the UK. The research was conducted online during March 2024.

** ISC census and annual report 2023

For further information please call Phil Anderson at Perception A on 07767 491 519