- 80% of headteachers, bursars and finance managers at fee-paying schools expect fees to rise faster than their historic rate

New research* with headteachers, bursars and finance managers at fee-paying private schools in the UK reveals that 77% say they are looking to increase their spend over the next two years to invest in their facilities and attract the best teachers.

Between now and 2025, 69% of those interviewed believe that their schools will increase their expenditure on facilities and staff by 10% or more, and 29% expect it to increase by more than 15%.

However, the study, which was commissioned by leading finance company Premium Credit, which through its Schools Fee Plan (SFP) provides funding to parents enabling them to spread the cost of their children’s school fees, reveals that 79% of those surveyed say that over the past three years they have had to delay or cancel investment plans in their schools because of delays around collecting fees for students.

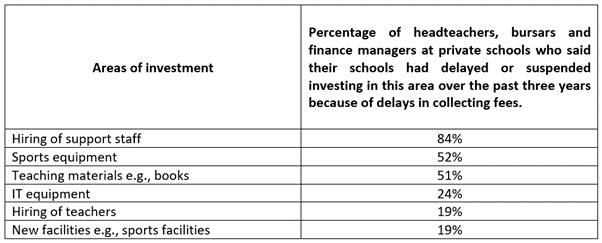

In terms of which areas their schools cancelled or suspended investing in because of late fees payment, 84% cited the hiring of support staff, and this was followed by 52% who said sports equipment, and 51% who said teaching materials, such as books.

With escalating costs, and to help support the increased expenditure on facilities and staff, 80% of headteachers, bursars and finance managers at private schools expect school fees to rise faster than their historic rate – nearly one in three (30%) anticipate them rising significantly faster than this.

Stewart Ward, Director Education Sector & Head of School Fee Plan, Premium Credit said: “Competition for pupils amongst private schools is intensifying and parents expect the highest standards for their children’s education. This means many schools are increasing their budgets for investing in their facilities and staff, and this in turn puts pressure on fees.

“We are seeing more parents looking to spread the cost of their children’s school fees - the number of clients who used SFP in 2022 was 84% higher than in 2021.”

For over 25 years, SFP has helped parents finance their children’s independent school fees by allowing them to spread the cost rather than paying a lump sum each term. SFP is the convenient and manageable way for parents to pay for independent school fees and extras such as music tuition and trips. It splits the cost into regular monthly direct debits, like any other household bill.

The process of applying for SFP for both parents and schools is seamless. Parents apply to open their account online before the beginning of any term. If the application is approved, SFP will notify the parents and the school. SFP sends the full payment to the school at the start of each term.

For further information on SFP, please click here.

Notes to editors:

*Premium Credit commissioned market research company Pureprofile to conduct research with head teachers, bursars and finance managers at fee paying schools in the UK. The research was conducted online during May 2023

**Based on Premium Credit analysis of data from schoolfeeschecker.com. This included the latest fees for day and boarding schools, and an annual increase of 4%. According to schoolfeeschecker.com, school fees have been increasing by around 4% since 2016. They increased by 5.1% year on year in September 2022.

For further information please call Phil Anderson at Perception A on 07767 491 519