- 44% of those using credit are using cards, and 34% are relying on finance from insurance and premium finance companies

- Of those businesses using more credit to pay for their insurance, Covid-19 is the main reason for this, followed by rising premiums

New research1 from the UK’s leading premium finance company, Premium Credit, reveals that 59% of SMEs are relying on credit to pay for their insurance, borrowing on average around £1,832. Some 16% of SMEs claim to be using over £3,000 of credit a year to buy their cover.

Premium Credit’s Insurance Index, which monitors insurance buying and how it is financed, found that of those companies using credit to pay for their insurance, 20% say they have taken on more credit over the past year for this purpose, but 30% say they have borrowed less.

In terms of the credit being used, 44% are using credit cards, and 34% are using premium finance and/or finance provided by insurers. Some 15% have used Government funding to buy their cover, but 10% have turned to friends and family to secure the finance needed to pay for their insurance.

Among those businesses using more credit, 50% said it is because of the impact of the Coronavirus crisis, and this is followed by 31% who cite rising insurance premiums. The corresponding figures from April this year were 73% and 36% respectively. (2)

The study reveals that nearly one in ten (9%) SMEs who use credit to pay for their insurance have seen their premiums increase dramatically over the past 12 months, and 47% say they have risen slightly. In terms of the steps taken by these businesses to combat this, 24% have made cuts to their business to reduce costs, 20% say they have increased their claims excess, and 20% have reduced their level of investment in operations. Some 18% have reduced their level of insurance cover, 14% have cut salaries, and 13% have also closed parts of their business. Only one in three (36%) say they have taken no action.

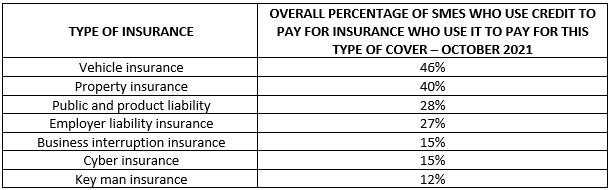

The table below shows the percentage of SMEs who use credit to buy insurance and which products they use it for.

Premium Credit’s research also shows the impact of not having insurance or being underinsured – 14% of firms say they have suffered damage to property or belongings over the past five years and were unable to claim for this because they didn’t have insurance or because they were underinsured.

Owen Thomas, Chief Sales Officer at Premium Credit commented: “Our findings not only highlight the importance of having insurance, but also the role credit plays in ensuring that businesses have adequate cover. The role played by brokers – especially because of the financial impact Coronavirus crisis has had on businesses up and down the country - has never been more critical.”

Premium finance companies like Premium Credit provide businesses and consumers with the opportunity to take out a loan to pay for their insurance in monthly instalments. By managing insurance payments in this way, businesses and consumers can spread the cost of their insurance, rather than pay their premiums in one go.

Notes to editors:

(1) Independent research conducted by Consumer Intelligence online among 737 SME owners and managers between October 1st and 5th 2021

(2) Independent research conducted by Consumer Intelligence online among 291 SME owners and managers between April 1st and 3rd 2021

For further information please call Phil Anderson at Perception A on 07767 491 519