With the cost-of-living crisis and schools fees increasing, new research* with headmasters, bursars and finance managers at fee paying private schools in the UK reveals that 48% are very concerned about a potential rise in children leaving their schools because their parents can’t afford the fees. A further 47% are ‘quite concerned’ about this.

The research was commissioned by leading finance company Premium Credit, which through its Schools Fee Plan (SFP) provides funding to parents enabling them to spread the cost of their children’s school fees.

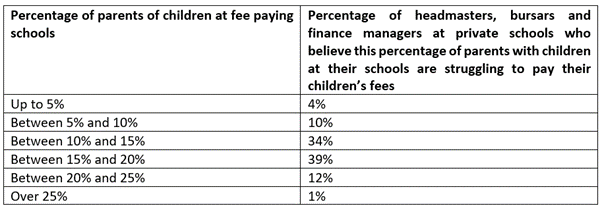

The study reveals that half (52%) of the head teachers, bursars and finance managers at private schools interviewed believe at least 15% of parents are finding it difficult to pay their children’s school fees.

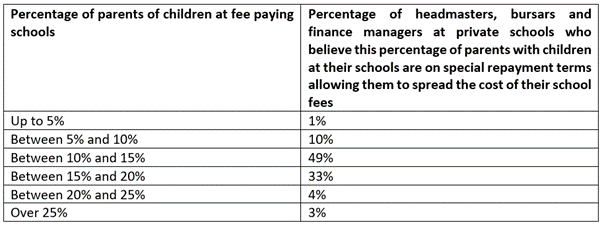

Some 83% of those interviewed say their schools are spending more time chasing parents for payment of fees. Four of ten (40%) of those interviewed say that at least 15% of their school parents are on special repayment terms allowing them to spread the cost of their school fees. Nine out of ten (89%) of those interviewed say they are increasingly looking for schemes run by professional firms to recommend to parents to help them spread the cost of their children’s school fees.

Jennie Hill, Chief Commercial Officer, Premium Credit (Specialist Lending) said: “With school fees rising by around 4% a year, we estimate** that it would cost around £355,516 to educate your child at a private day school up until their final year of a levels if they started reception class this academic year. It increasingly makes sense to spread the cost of school fees, even if you can afford to pay them.

“The number of clients who used SFP in 2022 was 84% higher than in 2021.”

For over 25 years, SFP has helped parents finance their children’s independent school fees by allowing them to spread the cost rather than paying a lump sum each term. SFP is the convenient and manageable way for parents to pay for independent school fees and extras such as music tuition and trips. It splits the cost into regular monthly direct debits, like any other household bill.

The process of applying for a SFP for both parents and schools is seamless. Parents apply to open their account online before the beginning of any term. If the application is approved, SFP will notify the parents and the school. SFP sends the full payment to the school at the start of each term.

For further information on SFP, please visit here

Notes to editors:

*Premium Credit commissioned market research company Pureprofile to conduct research with head teachers, bursars and finance managers at fee paying schools in the UK. The research was conducted online during May 2023

**Based on Premium Credit analysis of data from schoolfeeschecker.com. This included the latest fees for day and boarding schools, and an annual increase of 4%. According to schoolfeeschecker.com, schools fees have been increasing by around 4% since 2016. They increased by 5.1% year on year in September 2022.

For further information please call Phil Anderson at Perception A on 07767 491 519