- More than a third of SMEs have cut back on cover in at least one area of insurance in the past 12 months and nearly a quarter of them have cancelled policies completely

- But Premium Credit Insurance Index shows one in four plans to increase the level of insurance they have in the next 12 months

According to SMEs themselves or their brokers, around one in four (24%) SMEs are believed to have been underinsured for the past 12 months, new research* from the UK’s leading insurance premium finance company, Premium Credit, shows.

Premium Credit’s Insurance Index, which monitors changes to insurance buying trends, found a quarter of all SMEs (25%) believe the underinsurance problem has worsened in the past 12 months with 35% of all SMEs admitting they have cut cover over the period. Around a quarter (23%) of firms which have cut cover say they have cancelled one or more policies.

The research found more than half of firms (56%) say the total cost of their business insurance has increased since they last renewed policies compared with 13% who estimate costs have fallen.

However, there are signs SMEs are looking to tackle underinsurance with a quarter of firms (24%) planning to increase the level of cover they have. Part of that is being driven by firms switching to pay monthly with around 23% doing so in the past 12 months.

The main reason given by the SMEs which have switched to paying monthly is rising premiums with 43% highlighting that as a motivation while 32% said it made premiums more affordable and 24% said it helped with cashflow.

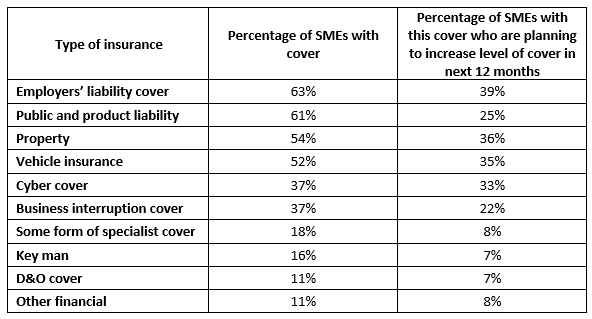

The table below shows the policy areas in which SMEs are planning to increase cover over the next 12 months with employers’ liability cover most likely to see increases.

Jon Howells, Chief Commercial Officer, at Premium Credit commented: “Underinsurance is an issue for SMEs with substantial numbers saying that they do not have enough cover after reducing or even cancelling policies.

“Rising insurance costs help to explain why firms are underinsured but it can’t be ignored and it is encouraging to see signs that SMEs are increasing cover.

“Switching to paying monthly for insurance and using credit helps with budgeting and makes policies more affordable while improving cashflow and allowing investment into other areas of the business.”

Notes:

(*) Independent research conducted by Viewsbank online among 463 SME owners and managers between October 31st and November 3rd 2025